Direct vs Regular Mutual Funds: Which One Grows Your Wealth Faster?

- INDRAJEET Pal

- Jul 26, 2025

- 3 min read

Updated: Aug 1, 2025

If you’ve ever invested in mutual funds or are thinking about starting, you have probably come across two options: Direct Plan and Regular Plan. Both plans invest in the same fund with the same portfolio and fund manager. But one tiny detail: “cost,” makes a huge difference. And that cost can silently shape your wealth journey.

So, let’s answer a common question: What are direct mutual funds, and how do they compare with regular ones?

What Are Direct Mutual Funds?

Direct mutual funds are mutual fund plans where you invest directly with the fund house, without any middleman like an agent, broker, or distributor. This means you don’t pay any commission, and the fund’s expense ratio is lower. As a result, you get higher returns over time.

In contrast, regular mutual funds are sold through intermediaries who help you choose funds and manage transactions. They receive a commission, which is built into the fund’s expenses.

Direct vs Regular Mutual Funds: The Real Difference

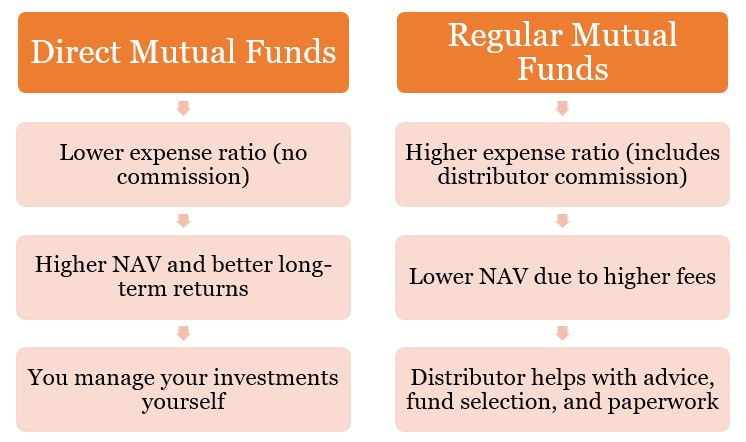

Let’s simplify the battle of direct vs regular mutual funds:

So, when comparing direct and regular mutual funds, the choice boils down to cost vs convenience.

Also Read: Goal-based Investing: The smarter way to Grow your Money

Why Lower Costs Matter So Much

Here’s a quick example to show the real impact:

Suppose you invest ₹10 lakhs for 20 years:

A direct plan with a 0.5% expense ratio could grow to ₹67.3 lakhs

A regular plan with a 1.5% expense ratio might grow to ₹58.1 lakhs

That’s a ₹9 lakh difference, just because of 1% in annual fees!

Lower fees allow more of your money to stay invested and compound, which makes all the difference in long-term wealth creation.

So, Why Do People Still Use Regular Plans?

Despite the benefits of direct plans, regular plans are still preferred by many because:

They offer human guidance

Advisors help avoid emotional mistakes during market ups and downs

Investors with complex financial goals often need support

In short, you’re paying for the handholding; and for many, that’s worth it.

Can You Switch from Regular to Direct?

Absolutely! It’s called a plan switch, and most fund houses and apps let you do it easily.

A few things to keep in mind:

Capital gains tax may apply if your investment has grown

There could be an exit load if you switch within a short holding period

But once the switch is done, your money begins enjoying the benefits of lower fees and higher compounding.

Final Thought: Make Your Money Work Smarter

If you’re wondering whether to go direct or stay regular, ask yourself:

Do I feel confident choosing funds on my own? → Try direct mutual funds

Do I want expert help with financial decisions? → A regular plan may suit you better

And here’s a little secret: some investors use both. They start with regular for guidance and shift to direct once they’re more confident.

Either way, understanding what are direct mutual funds, and how they differ from regular plans, can help you make smarter investment choices. After all, in investing, it’s not about what you earn; it’s about what you keep. Saving even 1% today could add lakhs to your future wealth.

Need help figuring out which plan suits you best? Explore tools, expert insights, and smart investment options at PD Wealth—your one-stop destination for wealth building made simple.

Frequently Asked Questions - FAQs

Q,.1 What is the difference between direct and regular mutual funds?

Ans: Direct mutual funds are bought directly from the fund house with no broker, so they have lower fees and give higher returns. Regular mutual funds are bought through a distributor or advisor, which includes commission, making them slightly more expensive.

Q.2 How do high fees and expenses in mutual funds affect investors?

Ans: High fees and expenses reduce your actual returns over time. Even a small difference, like 1%, can lower your final investment value by lakhs in the long run due to compounding. Lower costs mean more money stays with you.

Q.3 What factors contribute to the potentially higher returns of direct mutual funds?

Ans: Direct mutual funds have lower expense ratios because they don’t include distributor commissions. This cost saving boosts overall returns. Over time, the power of compounding on lower fees helps direct plans grow your money faster compared to regular plans.

Comments